“Enjoy the benefits of a large national bank and receive free cash if you meet the requirements.”

Looking for a new bank account? When you sign up for a new PNC Virtual Wallet account, which combines checking and savings, you can receive a competitive welcome bonus.

By opening a new account before the end of April and setting up direct deposits of $500 to $5,000 within the first 60 days, you can earn up to $400.

However, you will need to wait. The bonus may take up to 90 days to reach your account after you complete the qualifying activities.

Is this new account bonus worth considering? Let’s take a closer look at the bonus and PNC’s Virtual Wallet account to see if they suit your needs.

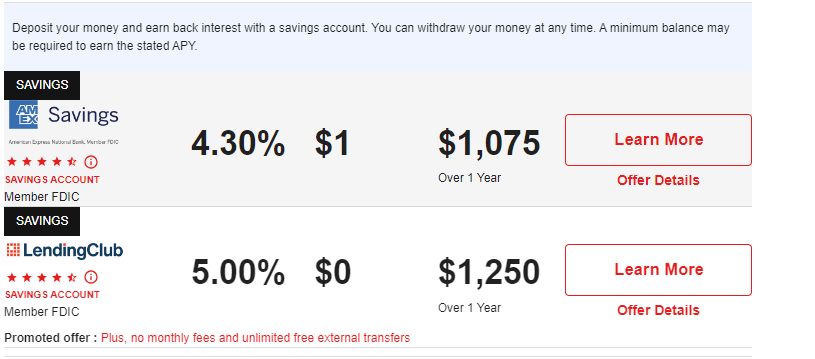

Leading bank accounts as of April 19, 2024

Earn $400 When You Sign Up for New PNC Bank Account offers

After verifying that you live in an eligible area by entering your ZIP code on PNC’s new account bonus website, you can receive $100, $200, or $400 in bonuses when you open a new PNC Virtual Wallet by April 30, 2024. The Virtual Wallet includes three sub-accounts:

- Spend checking account, which functions like a regular checking account.

- Growth savings account, similar to a traditional savings account.

- Reserve checking account, designed for short-term financial planning.

The bonus amount you qualify for depends on the total direct deposits you make in the first 60 days.

| Spend account | Bonus | Direct deposit minimum |

| Virtual Wallet | $100 | $500 |

| Virtual Wallet with Performance Spend | $200 | $2,000 |

| Virtual Wallet with Performance Select | $400 | $5,000 |

Qualifying direct deposits consist of regular recurring electronic payments from an employer or outside agencies like pensions or Social Security. New account holders can get the bonus if they haven’t been on any existing or closed account in the past 90 days or if they haven’t received a promotion bonus from PNC in the last two years. After you meet the direct deposit requirements, the bonus payment may arrive in 60 to 90 days.

PNC Virtual Wallet provides an overview

PNC ranks as the sixth-largest bank in the United States in terms of assets, according to the latest data from the Federal Reserve. PNC offers the convenience of a large national bank with innovative mobile tools such as savings goals, thanks to its over 2,600 branches and access to more than 60,000 fee-free ATMs, enabling you to manage your account from anywhere. With its Virtual Wallets with Performance Spend and Performance Select, you can receive reimbursements of up to $5 or $10 per statement cycle for out-of-network ATM fees.

However, similar to other large banks, PNC’s annual percentage yields (APYs) for its Virtual Wallet account don’t offer much attraction. The basic Virtual Wallet Spend account doesn’t provide interest. The Performance Spend and Performance Select accounts earn a minimal APY of 0.01% and require a monthly balance of at least $2,000.

Another common feature PNC shares with major banks is the monthly fee. Depending on your account activity, you could pay between $7 and $25 per month if your direct deposit falls below $500 to $5,000 in the Spend accounts or if you don’t maintain an average monthly balance of $10,000 in Performance Spend or $25,000 in Performance Select accounts.

Compared to the top checking accounts listed by CNET, the PNC Virtual Wallet doesn’t measure up to expectations. More attractive options are available, including some that offer bonuses.

| Bank | APY | Bonus | Monthly fee | Bonus requirements |

| Axos Bank | Up to 3.30% | $300 | $0 | Receive $5,000 in monthly direct deposits for the first seven months. |

| SoFi | 0.50% | $50 – $350 | $0 | Receive $1,000 to $5,000 in direct deposits within the first 25 days. |

| Laurel Road | 0.01% | $100 | $0 | Receive $2,500 in direct deposits within the first 60 days. |

| PNC Bank | 0% – 0.01% | $100 – $400 | $7 – $25 | Receive $500 to $5,000 in direct deposits within the first 60 days. |

Consider these factors when evaluating a new account bonus

PNC is a large national bank that provides convenient access to many people throughout the country. Having a bank with easy-to-reach branches and ATMs can be beneficial, especially if you need to deposit substantial amounts of cash or prefer in-person customer service.

If you live in an area where the new Virtual Wallet account bonuses are available and need a new checking account, it’s wise to consider all options.

However, opening a new account mainly for the bank bonus may cost you in the long run. Before choosing an account because of the bank bonus, keep these points in mind:

Check the fine print. Ensure you qualify for the bonus. PNC offers bonuses only in certain areas, so verify the bonus availability before opening a new account. Plan to pay taxes. Your bank will send you a 1099-INT form, and you must report any bank account bonuses to the IRS. Look at all fees. Each of the three Virtual Wallet Spend accounts carries a monthly fee. The fee can be waived, but make sure the conditions don’t create any issues for you. Know the account closure policy. Take note of any early account closure fees and avoid closing the account during that time frame. PNC also doesn’t offer a bonus to anyone who has closed an account within the past 90 days.

Is the new account bonus from PNC a good deal?

The PNC new Virtual Wallet bonus has some concerning conditions. If you can’t easily meet the minimum direct deposit requirements or maintain minimum combined Spend account balances to avoid a monthly fee, you might want to look for a new account bonus at a different bank. Paying a monthly fee would reduce any benefits from the $100 to $400 bank bonus.

Also, the interest rates on the Performance Spend and Select Virtual Wallets are not as competitive as those offered by other online banks’ checking accounts. Keeping a large balance to avoid the monthly fee while earning very little in interest may hinder your interest growth goals.

The basic Virtual Wallet has the lowest monthly direct deposit requirement to qualify for a bonus and avoid the monthly fee if you’re interested in the digital tools, physical branches, and national presence that PNC bank offers. Other banks like Capital One and Ally may offer similar features and services without a monthly fee. Consider all your options before deciding whether PNC Bank and its Virtual Wallet bonus are right for you.